In this competitive global landscape, it’s important to reduce risk to your bottom line. Whether you’re an importer making overseas payments to your supplier or an exporter with your sights set on overseas expansion, managing your currency risk exposure could make all the difference.

Below, we’ve created a list of key considerations to aid the growing number of businesses competing in today’s global environment.

1. Currency exchange rates

Getting a good rate on your international money transfers can make an immediate difference to your bottom line.

When you want to make an international money transfer, you can go to either a bank or forex specialist, which typically add a margin to the daily ‘market’ rate. This margin is usually where you’ll either save or lose money on your transfer. While banks and other popular providers will add extensive margins to their rates, specialists like OFX can offer more competitive exchange rates.

While the rate may not always seem like it impacts your transfer, when you put it into context it could mean the difference between thousands.

Reach out today to learn how OFX can help you with your money transfer needs.

2. Local context and regulations

It’s one thing to do business in your country, where the laws and regulations are known, it’s another thing entirely to extend that overseas.

Taking example from Australia, many Australian companies do extensive business with China, which can be tedious for unprepared foreigners. The Chinese government heavily regulates CNY, so to avoid delays to your payments ensure you’re up to speed with the following:

- Individual accounts cannot be used for business-related transactions. If you’ve been asked to pay an individual, it’s best to tread with caution and query the absence of a business account.

- Chinese banks often validate incoming payments with the receiver so you must have the name of the company’s primary contact to hand.

- References are also heavily monitored in China. It is important to assign a reference to your payment and ensure every character is correct. If not it could be rejected and subject to delays.

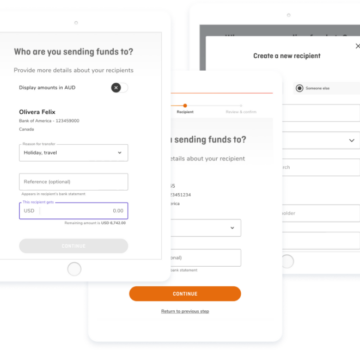

3. Paying international staff and suppliers

If your business has employees or suppliers in different countries this could mean repeated global payments. OFX’s regular payment and Forward Exchange Contract options may help to protect against potentially damaging exchange rate fluctuations. OFX can also deliver payments fast, and at a minimal cost to your business.

4. There will always be some risk

Depending on the frequency and size of your international payments, you’ll be subject to some degree of currency risk. The markets are often moving in accordance with significant geopolitical events, think Brexit or the US-China trade war.

This means that depending on your preferred currency pair, you may be up against some form of market volatility, and some risk in turn. The reality however is that more growth usually means accepting more risk whether you’re trading currencies, stocks, bonds or investing in real estate.

It’s worthwhile developing a currency strategy with a global money transfer specialist like OFX. The benefit of partnering with a specialist is the range of tools on offer that are developed for mitigating risk. A Forward Exchange Contract, for example, means that you can lock in a great rate at one time, and transfer with that rate at a later time, even 12 months down the line!

Register in less than 5 minutes

IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. OzForex Limited (trading as OFX) and its affiliated entities make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.