North American businesses’ confidence in cross-border trade improved in just six months since the last national study.

With the pandemic seemingly in the rearview mirror for many, the transition into a more open economy has so far presented unique opportunities to small and medium-sized businesses. OFX surveyed 602 business owners at the start of June to gage their confidence on trade topics. Our data shows that North American businesses are seeing more opportunities than ever for international trade.

The global economy has rapidly opened its door to trade again and small businesses have an opportunity to consider cross border expansion. To flourish in these times, successful businesses identified international suppliers and partners, understanding foreign currency markets and government support as the most important factors for cross-border success. Our results also show that those who participate in international trade tend to have more confidence in the future.

The North American SMB Cross Border Confidence Survey Key Results. Read the full report:

Reach out today to learn how OFX can help you with your money transfer needs.

Just over a year ago, many SMBs were devastated by the global COVID-19 pandemic. And in October of 2020, our data showed that only 39% of North American SMBs felt confident about the state of the global economy in the coming 6 months. Now, as we emerge from the pandemic, North American SMB confidence has increased, with 54% of respondents feeling confident about the state of the economy in the coming 6 months.

Three main factors are responsible for the increase in confidence:

- The progression of the vaccine program (51%)

- Greater opportunities than ever for international trade (43%)

- Global political stability (40%)

However, not all businesses are confident. Concern about the pandemic has grown with those who are not confident in the global economy. A staggering 68% listed this as a top concern. What’s more, 54% of those who are not confident in the global economy cited closed borders due to COVID-19 specifically.

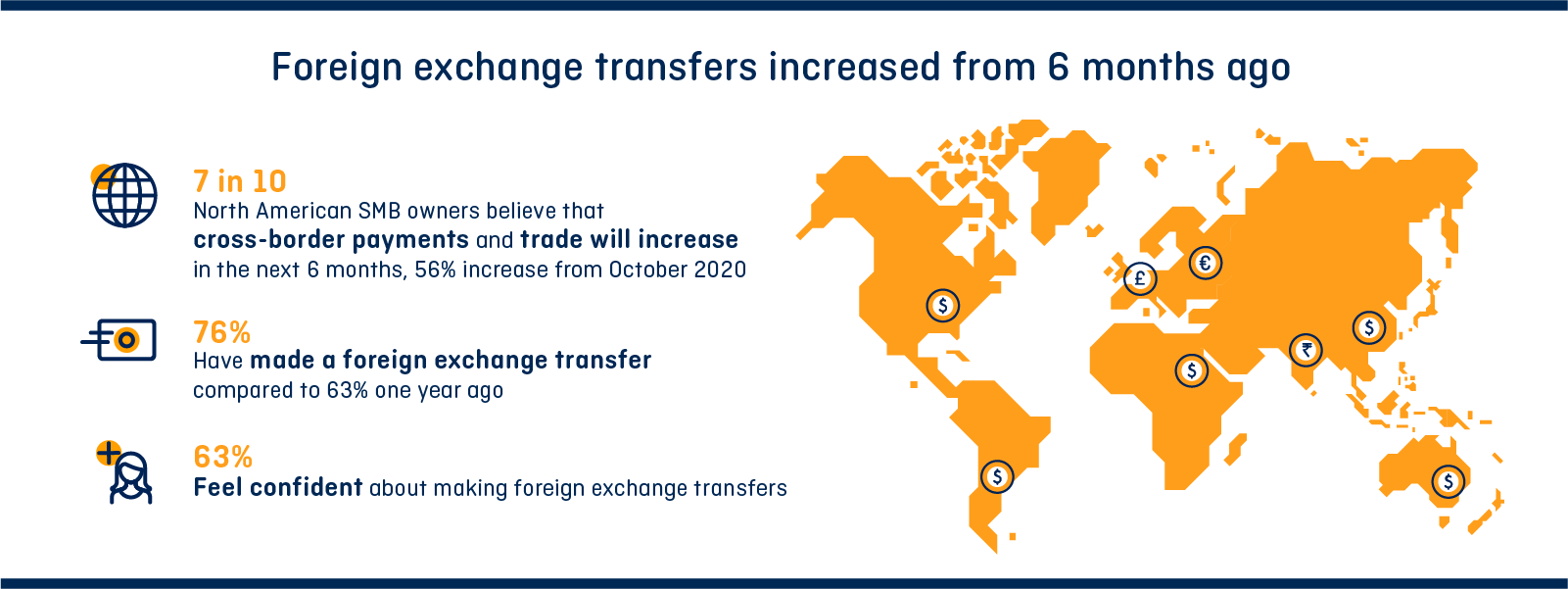

Cross-border confidence increases

The overall outlook for cross-border trade is positive. In fact, 7 in 10 North American SMB owners believe that cross-border payments and trade will increase in the next 6 months, a 56% increase from October 2020. And 76% have made a foreign exchange transfer — compared to 63% one year ago. Plus, their confidence in making foreign exchange transfers is high, at 63%.

But that’s not to say that North American SMBs don’t have concerns about foreign exchange. In fact, 47% are concerned about market volatility, 4 in 10 are concerned about their own lack of knowledge when it comes to making foreign exchange transactions, and, while the number has decreased, 37% fear being ripped off on fees, which was the biggest concern in October 2020 (47%).

SMBs find opportunities abroad

North American SMBs trading internationally or considering it don’t receive the same support from the federal government as SMBs operating domestically. 59% of North American SMBs operating domestically felt well supported by their federal government as compared to 48% of those operating internationally. This does represent a 41% increase from October 2020.

The support these SMBs feel both domestically and internationally, along with global economic conditions (38%), relationships with people or companies overseas (38%), and relationships with local business advisors (37%) have translated into confidence about expanding cross-border. In fact, 56% of respondents feel more confident about cross-border trading than they did 12 months ago — up from 49% in October 2020. When it comes to how North American SMBs are utilizing international trade, 35% trade internationally to export goods, 32% trade internationally to import goods or services, and 28% trade internationally to export services — which is a 155% increase from October 2020.

When these SMBs began trading internationally there were some common roadblocks they cited. Those included:

- Lack of knowledge or resources to get started (46%)

- A lack of contacts (37%)

- Lack of access to relevant business advisors (36%)

However, these SMB owners saw key benefits to international trade, including the growth opportunities (36%), low cost of sourcing goods outside of North America (36%), low production costs outside of their country (33%), and quality of goods outside of their country (30%). For the SMBs that have begun trading internationally, the benefits have outweighed the potential risks, and many are now reaping those benefits, with 43% of respondents reporting an increase in their customer base, 41% reporting increased revenue, and 36% reporting greater overall complexity in their business.

So you’re thinking about international trade

Of those who haven’t begun trading internationally, 69% are considering beginning to trade internationally in the next year — up from 61% in October 2020. And North American SMBs are especially keen on international trade if there were clear opportunities for growth (57%) or if consumer demand increased (57%). In October 2020, an increase in consumer demand was the top reason SMBs considered going international at 45%. Additionally, SMBs want to feel supported in navigating trade in new markets, with 31% saying that they would start trading internationally if they had help getting started.

To navigate currency markets confidently, 43% of North American SMBs feel they would benefit from a transparent fee structure, 38% say that the speed/efficiency of service helps alleviate their concerns, and 36% desire the ability to manage currency volatility. Strong customer service also plays a major role in the success of cross-border operations for North American SMBs. The data shows that respondents are most likely to request direct help with market volatility (46%), navigating big international events like COVID-19 (44%), when starting to trade in a new market (44%), and when starting to trade with a new customer or supplier (40%).

And, while overall confidence about international trade is up, some SMBs are still struggling to apply that confidence to their own business models, with 57% of respondents say that their lack of confidence in managing exchange rates has stopped them from trading cross-border or dealing with overseas suppliers (up from 46% in 2020) and 71% saying they would be more likely to begin trading internationally if they felt more confident about foreign exchange markets.

But this lack of confidence might be detrimental to business success. Our study found that, on average, SMBs who do not pursue cross-border trade miss out on an estimated $837,000 in potential revenue.1

The OFX North American SMB Cross Border Confidence Survey was conducted online between June 1 and June 6, 2021. It reflects the opinions of 602 owners of small and medium sized businesses in the US and Canada and has a margin of error of +/- 4 percentage points.

1 Survey question asked: “What is the revenue (estimated dollar amount) of the opportunity you have not pursued?” n=470.

IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. OzForex Limited (trading as OFX) and its affiliated entities make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.