International investing may seem complicated, but it doesn’t have to be. Sydney start-up Stake provides an online platform where Australians can buy US shares – without heavy brokerage or foreign exchange fees.

They set out to open up the US stock market, and tapped straight into a pent-up demand for a simple and affordable trading platform. In September 2017, less than 2 years from launch, Stake hit $30 million in trades – an impressive milestone!

We caught up with co-founder Matt Leibowitz to talk about how it all started, their journey so far and what’s next on the horizon.

What was your biggest inspiration for starting Stake?

“We’re surrounded by US companies changing the Australian landscape, from Netflix killing the DVD, to Amazon threatening our supermarkets and retailers. Yet many investors are still pushed to buy on the ASX, the very companies threatened by global companies.

For Aussies, buying US shares is hard — there’s tax forms, foreign exchange fees, a mess of old-school advisors, not to mention every trade is likely to cost $65 or more, no matter how small.

I, along with my other two co-founders, Dan and Jon, were frustrated that Australians couldn’t easily buy shares in the companies and ideas we wanted. So we built Stake, a super easy platform for anyone to buy US shares. We tied together dozens of partners and requirements into one, simple online shop that eliminates the sneaky charges and crappy user experience online investment has been plagued by for so long.”

“Everyone should have access to the opportunity in the US, so we’ve built it.”

The founders behind Stake built a platform that makes the US share market accessible for Australians.

What have been the biggest challenges in your start-up journey?

“Nothing comes easy. Particularly in trading and execution – the space is so detailed and technical. You need to know the intricacies of the market while working really hard to make it simple for our users. That’s our role here. Like any business starting up, it’s a roller coaster, but with a great team and partners around you, nothing is impossible.

We’re an early stage business, so finding the balance between continuing to grow rapidly while also ensuring our product is improving is a constant battle. We have chosen to make sure we’re servicing our existing customers ahead of growing our user base.

We’ve seen too many start-ups forget their current customers while chasing new ones, but it’s our early adopters who are most passionate about our product development and advocates who are sharing the movement. By focusing on their needs first, they help grow us and we keep improving.”

How would you reflect on your growth?

‘It’s actually funny. We focus on the customers we have, not on getting new ones. In some way, that’s helped us grow. ~85% of our customers have recommended us to another person as they love the product and the service they get. I think being a customer first business with a great product and great customers has been the secret (although that’s not really a secret!)”

If you could give one advice to other start-ups, what would it be?

“Focus. Have high ambitions, but be the best at the one thing your customers need. We made plenty of mistakes trying to do too much at the beginning. Now that we are in market, we’re just trying to be the best place to buy and sell US shares. If we can do that, the rest will follow.”

What’s next for Stake?

“Our app is next on the horizon and the program to thank customers that share us with their friends is also around the corner. Beyond that… only time will tell.”

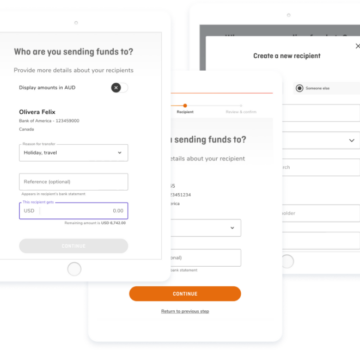

Stake has tied together dozens of partners in order to offer end-users a seamless experience, where buying US stocks is as easy as online shopping. By partnering with OFX, Stake’s clients do not only enjoy $0 brokerage but also highly competitive FX rates when transferring funds to the US. Find out how Stake uses the OFX Payments API.

IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. OzForex Limited (trading as OFX) and its affiliated entities make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.