US businesses optimistic about global economy despite ongoing pandemic

National study highlights US businesses confidence in cross-border trade

It is likely an understatement to say that the year 2020 has so far presented unique challenges to small and medium-sized businesses. OFX surveyed 690 business owners at the end of September to gage their confidence on trade topics. Our data shows that US small businesses miss out on more than $1 million in annual revenue by not reaching other international trading audiences.

Now more than ever, it’s important for small businesses with the right mindset to consider cross border expansion. To get going, the steps identified by successful businesses include getting exposure through education and making an action plan. Our results also show that those who participate in international trade tend to have more confidence in the future.

Read the full report: Download the US SMB Cross Border Confidence Survey Key Results

Get the cliff notes: Read the infographic today

Get in touch: Reach out today to learn how OFX can help you with your money transfer needs.

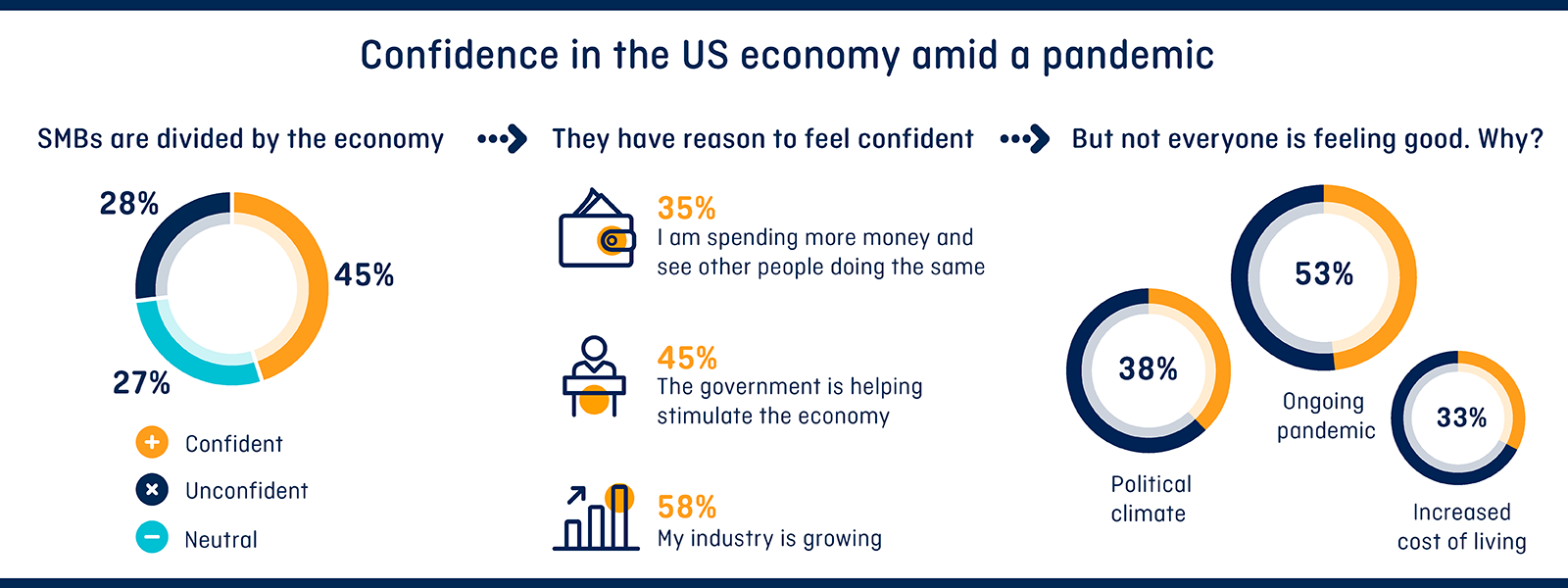

Overall, small and medium sized businesses are reasonably confident about their prospects for the US economy in the coming six months. Nearly half (45%) of the respondents said that they felt confident about the state of the US economy. Further, over 80 percent believed that the business outlook for American businesses was positive. The reasons for feeling positive included growth within their industry, government help and seeing others increase spending.

Not surprisingly, the ongoing COVID-19 pandemic and the US political climate both factored into their concerns for future growth. For example, the pandemic and its impacts are more concerning than who will be the next president. Of those who feared an economic downturn in the next six months (38%), 74 percent were more likely to blame the pandemic.

The overall political climate as it relates to business confidence is concerning for all the respondents. However, the 55% who said they were not confident about the domestic prospects for the next 6 months are more likely to be concerned about the political climate than those who were confident.

Global economy: The opportunities of cross-border trade

Small business leaders tend to be less confident in the strength of the global economy, with 20% citing confidence in the global economy versus 25% who are not confident. Higher confidence is correlated with participation in global cross border trade evidenced by 75% believing the volume of US SMB cross-border trade and payments will increase or stay the same. On another positive note, 49% say they are more confident about trading internationally now than they were six months ago.

The survey respondents who were already operating globally (50%) find better growth opportunities outside the US. Of these, over half saw increased revenue and 46% grew their customer base. Over a quarter of respondents find that services abroad were either more affordable than the US market or unavailable in the US. To add more color to this, small businesses operating across borders said that it’s more affordable to source and produce goods outside the US, with 33% saying this allows them to lower supply costs and make them more competitive.

For insight into the types of businesses conducted by the three out of five respondents

- ⅓ are either importing or exporting goods or services

- ⅓ are importing goods

- ⅕ are exporting

- ⅕ are both importing and exporting.

Lack of international experience burdens small businesses

Small businesses not trading globally recognize they may be losing out on opportunities. Over four of five respondents estimated that on average, a lost global opportunity cost them about $1.4 million in revenue.1

The reasons cited for refraining from global trading included lack of market experience and knowledge along with fear. More than half (54%) lack international experience and connections. This inexperience carries into several aspects of global trade.

In general, the idea of managing foreign exchange is a major hurdle for US businesses who are not yet trading internationally. Among these, more than three quarters of SMBs say they would begin trading internationally if they felt more confident about foreign exchange markets. We surmise that this is due to the dominance of the US dollar as a reserve currency.

Other barriers to action cited are a lack of international business experience (37%) and a lack of knowledge of local economies (27%). The most often cited barrier though was the fear of being ripped off or being taken advantage of in the exchange of currency: 44% said they feared losing out and 36% said they thought suppliers would rip them off. This is extraordinary when you consider that most foreign suppliers invoice US businesses in USD and manage the currency exchange themselves because most American businesses tend to prefer to pay in USD. So while they worry about losing out, they also do not proactively attempt to manage the exchange. They seem to not realize that if they handled it themselves with the help of a supporting partner like OFX they could have greater control of their costs and cash flow.

When you’re ready for international trade

US SMBs are more positive about the outlook for the US economy than they are for the global economy by a small degree (45% versus 41%). Once again, challenges created by COVID-19 at the local and global level influence businesses confidence in their global opportunities. Global concerns can be somewhat alleviated with transparency, communication and the right support network. A desire to know more about foreign exchange pricing (38%) as well as the ability to speak to an expert about the foreign exchange market (44%) are the most common ways cited by businesses to alleviate their challenges.

Exchanging one currency for another as part of your business is far simpler than most small businesses realize. For example, one in five small businesses say that information on ways to structure payments would help them. Using a currency expert like OFX to help navigate currency markets can remove some of the complication. Businesses might be worried about the volatility of the markets but with the right strategy in place, there is an opportunity to improve exchange rates, manage cash flow and save.

The OFX US SMB Cross Border Confidence Survey was conducted online between September 25 and September 31. It reflects the opinions of 690 owners of small and medium sized businesses in the US and has a margin of error of +/- 4 percentage points.

1 Survey question asked: “What is the revenue (estimated dollar amount) of the opportunity you have not pursued?” n=470.IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. OzForex Limited (trading as OFX) and its affiliated entities make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.