Traditional business bank accounts have long been at the core of day-to-day business operations. But when it comes to financial management beyond simply holding funds, modern non-bank digital alternatives give growing businesses, like your startup, a sharper competitive edge.

From automating your finance operations to offering competitive FX rates for international money transfers, modern business account software can free up your precious time, while keeping costs low. With additional service offerings such as multi-currency support and expense management, your startup can scale with the right foundations.

In this guide, we’ll break down the different types of business accounts, highlight smart fintech alternatives, and show you how OFX can support your startup’s growth through every stage.

Jump to:

• What is a business bank account?

• Types of business bank accounts

• Eligibility requirements for a business bank account

• Why is it important to open a separate business bank account?

• Business bank account vs business account

• Can you open a business account alongside a business bank account?

• Overview: best business bank accounts for startups

• Comparing business account alternatives

• Breakdown: best business bank accounts in the UK

• How to choose the right business bank account

• Why startups are choosing OFX

What is a business bank account?

A business bank account is a financial account, opened with a bank for managing the finances of a business. They are available to businesses of all sizes and industries, and you can usually find them as account options at all banks in the United Kingdom.

Types of business bank accounts

There are several types of common business bank accounts designed for specific business needs. They include:

- Checking accounts (or current accounts): for everyday transactions and payments

- Savings accounts: for holding extra funds and accruing interest

- Merchant accounts: for businesses which accept card payments (e.g. e-commerce)

- Payroll accounts: for paying and managing employee salaries and tax withholdings

- Deposit accounts: for short to long-term investments (fixed term)

Some banks and financial institutions also offer accounts designed specific to company size, for example, specialised startup bank accounts with online banking capabilities and accounting integration.

Eligibility requirements for opening a business bank account in the UK

General eligibility requirements for opening a business bank account for your startup in the United Kingdom include:

- UK-based: Businesses often need to prove they have a physical address in the United Kingdom1

- 18+ years applicant: The account owner will need to be over 18 years of age and provide identification documents such as a national ID card or passport

- Business legitimacy: Verification of startup business operations (e.g. with a Certificate of Incorporation, Companies House number, Articles of Association)1

- Proof of activity: Some banks may require proof of business operations with cashflow forecasts, business plans, and/or invoices1

- Deposit accounts: for short to long-term investments (fixed term)

Although different banks and financial institutions may have slightly varied eligibility requirements, the process of opening a business bank account is usually quite straightforward. Keep in mind, traditional banks can take a couple of weeks to approve a business account, while digital banks often open accounts in less than a week (provided all eligibility requirements are met).

Why is it important to open a separate business bank account?

Opening a business bank account is often an essential first step for startups simply due to the benefits a bank account provides. A business bank account will help:

- Separate your business finances and personal finances for legal protection purposes

- Keep your business finances organised with cashflow tracking and dedicated bookkeeping

- Simplify reporting processes come audits and tax time

- Show legitimacy and professionalism to potential investors and clients

However, if you’re looking to open an account that handles more than just making and holding payments, a business account might be a good alternative (or even compliment) to a traditional banking account.

Usually offered by regulated fintech organisations, business accounts often come with extra features such as spend management tools, multi-currency support, and accounting software integration.

What’s the difference between a business bank account and a business account?

Below’s a brief overview of the main differences between traditional business bank accounts and other business account options, and how they may be alternatives or complimentary to each other.

| Business bank account | Business account | |

| Provider | Traditional banks, neo-banks with banking licence | Fintech organisations, neo banks without banking licence |

| Purpose | Holding money, making payments, access to credit, lending and investing | Holding money and making payments alongside additional financial management tools such as AP workflows, corporate cards and multi-currency support |

| Regulations | Regulated by the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA) | Regulated by the Financial Conduct Authority (FCA) for electronic money and payment services |

| Examples | Barclays Business Account, HSBC UK Small Business Banking Account, Monzo | OFX Global Business Account, Wise Business Account |

As seen per the table above, the key difference between a business bank account and a business account is the additional tech-driven solutions provided by the latter.

Can you open a business account (from a FinTech) alongside a business bank account?

Yes, many of our clients have bank accounts for legal or borrowing purposes whilst leveraging an OFX Global Business Account to help save them time and money on their financial operations and currency transfers.

I was recommended to use OFX, but honestly I wish I knew about it sooner. By far OFX is the most competitively priced and easiest platform we’ve ever used. The user experience and customer service have been a lot better for our finance teams to manage,” said Jonathon, co-founder of BikesOnline.

Best business bank accounts for startups: an overview

Deciding which business bank account to open out of hundreds in the UK may be a tough process. To help keep things simple for you, we’ve put together a list of the top business bank accounts in the UK and how they compare with each other, based on key features, rates and fees, and their Trustpilot rating.Although both can be used to hold money and make payments, banks may have added accessibility with ATMs and physical branches for cash withdrawals. They may also be beneficial if your startup is looking to further lender relationships and make investments.

| Bank/provider | Type | Key feature(s) | Rates and fees | Trustpilot rating |

| Monzo | Online bank | • Free and paid business bank account options5 • Lite (free), Pro (£9/month), Team (£25/month)6 | • Zero monthly fees on Lite account6 • 1% currency conversion fee and cash withdrawal fees | 4.6/5 |

| Starling Bank | Online bank | • Free Business Current Account with customised (paid) add-ons7 | • No fees charged on Business Current Account8 • Further information on rates,fees, and charges | 4.2/5 |

| HSBC UK | Bank | • Small Business Banking Account for startups4 | • No monthly fee • Transaction fees according to Business Price List | 4.4/5 |

| Barclays | Bank | • Digital bank account with accounting software (if opened using Online Banking)2 • Cashback and rewards with a Barclay business credit card2 | • No monthly fee for first 12 months3 • After 12 months, pay £8.50 per month3 | 2.3/5 |

Comparing alternative business transaction accounts

When it comes to alternatives to traditional business bank accounts, the most common solution available to startups are business transaction accounts, often with added capabilities such as spend management and multi-currency support.

Best business accounts for international payments & finance automation

| Provider | Key feature(s) | Rates and fees | Trustpilot rating |

| OFX | • Holds 30+ currencies • All-in-one financial management platform | • Standard plan (free) • Full Suite plan (£125/month) • Custom pricing available | 4.4/5 |

| Revolut | • Holds 30+ currencies9 • Crypto investment options10 | • Basic plan (from £10/month)11 • Grow plan (from £30/month)11 • Scale plan (from £90/month)11 • Enterprise plan (custom)11 • No fees until outside monthly allowance11 | 4.6/5 |

| Wise | • Holds 40+ currencies12 • Funds in Wise earn interest12 | • Business – one-off £45 registration fee12 | 4.3/5 |

For a more detailed breakdown of the best bank business accounts and their alternatives, check out our list below.

Best business bank accounts in the UK: a breakdown

Keep reading for a more detailed breakdown of the features between traditional business bank accounts as well as digital alternatives.

Monzo Business Bank Account (neo-bank)

Monzo is known as one of the best digital banking providers in the UK, with the Business Bank Account available to most businesses, regardless of size. It offers many benefits, including tax and accounting tools, interest earned through savings, corporate cards, and tax help (on the paid account plans)5.

Who it’s good for:

- Startups that may also be looking for a loan of under £100,0004

- Businesses with strong focus on scalability due to options of paid account plans

- Businesses requiring quick turn-around times (91% of business accounts are opened on the same day5)

What to keep in mind:

- Account features may be limited in the free Lite plan

- Overdrafts and loans are only available to eligible sole traders5

- Employee expense cards are only available with the Team plan, starting at £25/month6

Starling Bank Business Current Account (neo-bank)

Starling Bank’s Business Current Account is a free digital business account opened within the bank app that is used by over 500,000 UK businesses to date7. With no monthly fees or UK payment charges, the account also comes with a Mastercard debit card with customised subscription-based add-ons that you can purchase according to your startup needs7.

Who it’s good for:

- Startups on a budget who want a simple digital banking business account

- Account owners preferring in-app functionality rather than traditional banking

What to keep in mind:

- Not designed specifically for startups with no small business growth programs

- Multi-currency support is limited to Euro and US dollar and requires paid customised add-ons7

HSBC UK Small Business Banking Account

HSBC has a dedicated Small Business Banking Account fit for small businesses and startups, where account holders can participate in the HSBC Small Business Growth Programme to upskill and connect with other small businesses via webinars and events. Account holders are offered borrowing solutions of up to £100,000 and UK digital banking4.

Who it’s good for:

- Startups that may also be looking for a loan of under £100,0004

- Businesses which prefer digital banking solutions

What to keep in mind:

- There is an annual fee for corporate cards after 12 months4

- Businesses will need to meet specific eligibility requirements to be approved for the Small Business Banking Account

- Support is offered through virtual assistant and live chat, and there is no dedicated account manager

Barclays Business Bank Account

Barclays Bank supports over 900,000 businesses in the UK and their business account is a tried and trusted account with digital banking capabilities2. Aside from the usual bank account services, the Barclays Business Bank Account also includes free accounting software as well as access to the Eagle Labs Accelerator programme designed for entrepreneur mentoring2.

Businesses who open a Barclays Business Account also get access to the Barclaycard credit card, which can be used to earn cashback and rewards. Additionally, the bank offers 24/7 business support via the Help Section of the Barclays app2.

Who it’s good for:

- Startups looking for a standard bank account to help with manage their cashflow

- Entrepreneurs looking for networking, mentoring, and scaling opportunities

What to keep in mind:

- Customer support is through the Barclays app and there is no dedicated account manager to resolve potential problems

- Foreign currency accounts support only 17 currencies2

- The closing of more physical branches in the UK may mean limited access to in-person support

Revolut Business Account (neo-bank in UK with restrictions)

The Revolut Business Account is a multi-purpose account that offers financial management services, multi-currency support, and accounting software integration9. The platform also offers crypto investment options and corporate cards that account holders can use online and in-person9.

Who it’s good for:

- Businesses who need services outside of basic payment functionality, including expense management

- Businesses making international payments

What to keep in mind:

- There are no free account plans, Basic plan starts at £10/month11

- Revolut is primarily an online provider with no physical branches for in-person support

Wise Business Account (non-bank)

The Wise Business Account is another non-bank financial management account which supports businesses with FX transfers, accounting software integration, and corporate cards. The platform is safeguarded by local regulations and the one one-off account setup fee is £4512.

Who it’s good for:

- Businesses making international payments in common currencies on the regular12

- Businesses looking to get started and keep monthly account fees low

What to keep in mind:

- Wise finance automation & spend management features are limited and offer no accounts payable automation

- Wise is primarily an online provider with no physical branches for in-person support

OFX Global Business Account (non-bank)

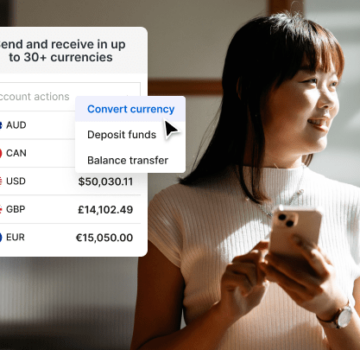

The OFX Global Business Account is an all-in-one financial management platform that helps businesses take further control of their finances with multi-currency support in 30+ currencies, expense management tools, corporate cards, and more. From AP and bill automation, to batch transfers, the OFX Global Business Account lets you keep track and control all your business transactions in one convenient place.

Who it’s good for:

- Startups that need to save time and eliminate errors with expense management tools

- Businesses that make international payments in multiple currencies

- Startups trying to minimise costs with the free Standard plan (for first two users)

- Businesses ready to automate their finances with customisable approval flows and tracked budgets

What to keep in mind:

- OFX is a fintech with no physical branches for customer enquiries, however has 24/7 support with an OFX specialist available via call or email

- Cashback on corporate cards is only available to businesses on an OFX Full Suite plan

OFX Global Business Account

Receive, hold, convert and send funds across a wide range of currencies, reduce costs and gain greater control over your international payments.

How to choose the right business bank account for your startup

Having a business bank account is almost a no-brainer for your startup, but choosing the right one can be a bit more of a difficult decision. Similar to personal bank accounts, there’s a lot of factors to consider when considering which business bank account is best for your startup and specific business needs.

- Key features offered: are there any specific banking products or services you’re after?

- Rates and fees: do you have a tight business budget where minimising bank fees and rates is necessary?

- Traditional vs. digital banking: which method of banking best suits your business operations? Or are you open to alternative banking solutions?

- Reputation and security: who do you trust with all your business financial information?

- Scalability: can the account grow with your business?

- Eligibility requirements: does your business meet the eligibility requirements for a business account with a specific bank?

- Reviews: what is the general customer experience for particular bank services?

And for a more detailed look at how you can choose the right business bank account for your startup, we’ve compiled a few tips for you to keep in mind.

1. Weigh up key features of bank accounts with your business needs

Many business bank accounts offer product services outside of basic holding and sending, and it’s up to you to consider what your business absolutely needs and what may be a good-to-have.

For example, if you need bookkeeping services, Starling Bank offers a subscription-based add-on to business accounts called the Business Toolkit, that is designed to streamline business bookkeeping. However, it also offers Euro and US dollar multicurrency accounts, which may not be relevant to your business if you’re not making international payments on a regular basis.

2. Consider rates and fees

Not all bank accounts are free – some may have monthly fees and others may require you to pay a monthly fee after a certain number of months. Make sure to check if a bank account you’re planning to open has fees and whether you’re happy to pay it if it does.

3. Decide between traditional or digital banking, or both

Especially in the case of a quick-moving startup, it may be even more important to have accessible and reliable banking services with fast turn-around times to help keep you on top of your game.

Traditional banks tend to have slower service turn-around times than digital banks, especially when you factor in self-serve services that you can access via bank apps. However, if your startup is cash-based, it may be helpful to consider a traditional bank due to the availability of their physical branches and ATMs.

4. Enquire about customer support

When considering the right business bank account for you, make sure to enquire around customer support and service, and whether you’ll be able to speak to a team member 24/7 in case of problems.

5. Research each bank’s security measures

You need to be able to trust your bank with your money and although all banks in the UK are regulated by the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA), security measures may differ slightly from bank to bank.

In the UK, most banks are covered by the Financial Services Compensation Scheme (FSCS), which protects eligible deposits for up to £85,000 per eligible depositor.

6. Check eligibility requirements

Eligibility requirements for opening a business bank account vary slightly from bank to bank, but most will require identity verification (for both account holders and the business itself), proof of a UK-based address, and documents to establish legitimacy of business operations (e.g. business plans)1.

Small business bank accounts may require other specific eligibility documents (e.g. proof of size) so it’s important to check that you meet eligibility criteria before even considering opening a business bank account with a particular bank.

7. Read past customer reviews

A great way to evaluate business bank accounts and weigh them against each other is to have a look at past customer experiences on reputable review sites like Trustpilot. These reviews may give you a fair idea of what you can expect from certain bank services, and whether common praises or complaints may be relevant to your business.

In particular, it’s always a good idea to check out reviews on customer service and support experiences so you know what you can expect if you run into a problem while using the business bank account.

Why are startups in the UK choosing to open an

OFX Global Business Account?

Despite the multitude of business accounts available in the UK, many are choosing to open an OFX Global Business Account simply due to the benefits it offers, especially when compared with other bank accounts, often with higher FX rates.

The key differentiator between the OFX Global Business Account and others is that it empowers your startup to hit the ground running, while opening doors for growth and scalability.

OFX offers an all-in-one global business account that’s built to help businesses expand and operate globally without the hassle. With one platform for greater visibility and control, you can track every expense in one place, control your spending before it happens and have 24/7 support without high monthly fees. Manage your business efficiently with technology that helps drive growth.

Achieve more with the OFX Global Business Account:

- Open domestic and multi-currency business accounts within minutes

- Save on currency conversions and earn cashback rewards with corporate cards

- Gain more budget control with employee and company, physical and virtual cards

- Track your expenses, capture receipts, and manage spend before it happens

- Pay invoices and employees in bulk with batch payments

- Get 24/7 support from real people who understand your needs

Don’t let traditional banking slow you down. Open a Global Business Account with OFX and see how our all-in-one platform can transform your business.

Get started with a free Standard plan, or invest in a Full Suite for £125/month to gain access to spend management tools, AP and bill automation, cashback on corporate card spend, and more. For more information, check out our pricing plans.

Looking for an alternative to your bank?

Business bank account FAQs

Below are answers to some of the most commonly asked questions regarding business bank accounts.

What is the best business bank account for startups?

The best business bank account for startups depends on your specific business needs and the kinds of banking services you’re looking for. For example, some banks only offer digital banking services while others have physical branches and ATMs.

Some bank accounts are also designed for startups, with small business growth programs that offer upskilling and networking opportunities. It’s important to compare the features of the business bank accounts and decide which is best for you.

How to open a business bank account?

Opening a business bank account is usually a simple process that depends on the bank you’re opening an account with. Some banks may require you to prepare documents to verify eligibility first before you can open your account. After confirming your eligibility, you can simply complete the application online or in-branch.

How to close a business bank account?

The process of closing a bank account differs from bank to bank. Enquire with your bank’s support team to find out how to close your specific business bank account.

What are the top business accounts in UK in 2025?

Here are some of the top business accounts in the UK:

- OFX Global Business Account

- Starling Bank

- Monzo

- Barclays

- HSBC UK

- Revolut

- Wise

Can I use my personal bank account for business?

Yes, you technically can, but this may make managing your business finances more difficult due to the lack of separation.

What is required to open a business bank account?

Eligibility requirements to open a business bank account differ from bank to bank. Check with the bank you’re interested in opening an account with to determine their exact eligibility requirements, although most will include identification, proof of business operations, and business legitimacy verification.

References

- https://www.business.gov.uk/invest-in-uk/expand-your-business-in-the-uk/guide/detailed-guides/how-to-choose-and-set-up-a-uk-bank-account/

- https://www.barclays.co.uk/business-banking/

- https://www.barclays.co.uk/content/dam/documents/business/Accounts/B0213_BAR0324764636-001_PN8206607_9918661_UK_0324_WCAG.pdf

- https://www.business.hsbc.uk/en-gb/products/small-business-bank-account

- https://monzo.com/business-banking

- https://monzo.com/business-banking/plans-pricing

- https://www.starlingbank.com/business-account/

- https://www.starlingbank.com/docs/legal/account/Rates-Fees-and-Charges-BCA-and-STCA.pdf

- https://www.revolut.com/business/

- https://www.revolut.com/business/crypto-business/

- https://www.revolut.com/business/business-account-plans/

- https://wise.com/gb/business/

- https://www.ofx.com/en-ie/business/global-business-account/