If your business operates across borders, you’ll know how quickly managing different currencies can become complicated. From dealing with fluctuating exchange rates to navigating high conversion fees and delays in international payments, the costs can really add up.

Whether you’re paying overseas suppliers, receiving payments from global clients, or managing expenses in different markets, finding a smarter way to handle foreign currencies is essential.

Specialised multi-currency business accounts are designed to help businesses hold, send and receive payments in multiple currencies, without the need to convert everything back to pounds. By using a multi-currency account you can reduce conversion fees, speed up international transfers, and take more control over how and when you exchange money.

In this article, we’ll explain how multi-currency accounts work and break down some of the most popular account options available today to help you find the right fit for your needs.

Summary:

• What are multi-currency accounts?

• Banks currency accounts vs digital-first multi-currency accounts

• How do I compare multi-currency accounts in the UK?

• Best multi-currency accounts in the UK

• What currencies are usually available for UK multi-currency accounts?

• What’s the eligibility in the UK for a multi-currency account?

• How to open a multi-currency account

• Try the OFX Multi Currency Account for free

• Best multi-currency accounts FAQs

What are multi-currency accounts?

A multi-currency account is a business account that allows you to hold, send, and receive money in currencies other than pounds sterling. Designed for individuals and businesses who operate internationally, these accounts can help you manage overseas payments more efficiently and avoid unnecessary currency conversion fees.

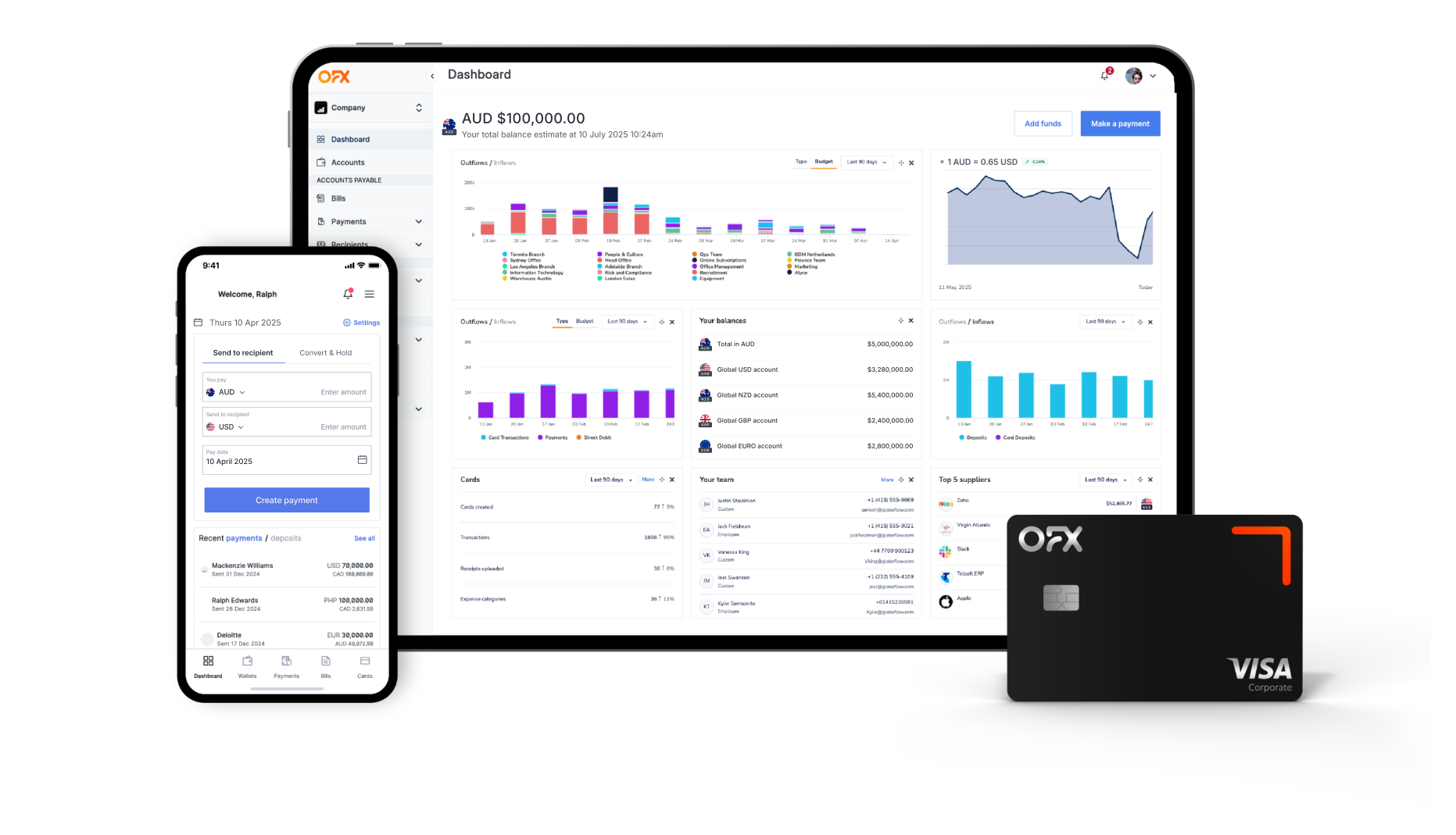

Some multi-currency accounts, such as those you can get access to with the OFX Global Business Account, let you hold multiple currencies under one roof, making it easier to manage international transactions without juggling several separate accounts. They can be paired with corporate debit cards for spending abroad or allow online transfers with competitive exchange rates and competitive fees.

It’s worth noting that features vary between providers, some accounts are app-based, others are tailored for business use, and not all offer a debit card like OFX. You should compare fees, available currencies, and transfer speeds before opening a business account.

What are the differences between bank-based multi-currency accounts and digital-first providers?

Traditional UK banks offer multi-currency accounts, but they often come with limitations. These accounts typically support only one currency per account and may involve monthly maintenance fees or charges for certain transactions. In many cases, you’ll need to visit a branch or speak to a relationship manager to open or manage the account. Some also require a minimum deposit or balance to avoid extra fees.

Many traditional multi-currency accounts don’t include spending features like a debit card or app-based management. While they can be useful for holding funds in a single currency or making occasional transfers, they’re not always the most flexible option for frequent international use.

Multi-currency accounts from digital-first providers are designed for modern international needs. These accounts let you hold, spend, and convert multiple currencies from a single app or online platform—without the need to open separate accounts for each currency. Many of them offer real-time exchange rates, lower fees, and added convenience for sending and receiving money globally.

Digital-first accounts such as the OFX Global Business Account, come with useful features like:

- Real-time exchange rate tools and currency conversion with no hidden markups: Allows you to monitor current exchange rates and convert currencies transparently without extra fees added on top of the market rate.

- Multi-currency debit cards so you can spend directly from your foreign balances: Enables you to make payments and withdraw cash abroad using a single card linked to multiple currency accounts.

- Local account details (such as IBANs or sort codes) in multiple currencies: Provides you with local accounting details in different countries, making it easier to receive payments.

- Fast or instant international transfers: Allows businesses to send money overseas quickly, reducing waiting times for cross-border payments.

- Simple in-app currency management: Lets you easily view, convert, and manage multiple currencies within a user-friendly mobile app.

| TL;DR | |

| Traditional bank accounts usually support only one currency per account, come with more fees, and may require manual or in-person setup. | Digital-first multi-currency accounts support dozens of currencies under one login, offer better exchange rates, and let you manage everything from your phone. |

OFX Multi-Currency Account

Built for modern businesses, the OFX Multi-currency account allows you to hold multiple currencies in one place, convert funds when it suits you, and simplify your global payments.

How do I compare multi-currency accounts in the UK?

When comparing multi-currency accounts in the UK, businesses should focus on features that support smooth and cost-effective international transactions. Key considerations include supported currencies, transfer fees, exchange rates, and how easily the account integrates with existing financial systems.

Things to keep an eye out for:

- Number of supported currencies

Having a single account that supports multiple currencies allows businesses to easily manage international payments and streamline currency handling. This reduces complexity and administrative effort, making global transactions more efficient.

- Monthly fees and eligibility

Accounts without monthly fees or minimum balance requirements offer businesses greater cost savings and financial flexibility. In contrast, accounts with fees or strict eligibility criteria can increase costs and limit convenience, affecting cash flow and ease of use.

- International transaction costs and FX mark‑ups

Accounts offering competitive exchange rates with no extra fees on transactions help businesses save money when handling multiple currencies. Conversely, markups and transaction fees can raise costs, so understanding these charges is key to managing expenses effectively.

- Account access and platform flexibility

Fully digital accounts with quick online onboarding and 24/7 access enable businesses to manage finances efficiently from anywhere. Accounts requiring phone or branch visits can slow down processes and add complexity, reducing overall convenience.

- Transfer speed and operational flow

Fast currency conversions and instant or low-cost international transfers help businesses manage cash flow and meet deadlines efficiently. Slower transfer times, especially for less common currencies, can disrupt operations, making it important to understand speed differences when choosing an account.

- Linked cards and spending convenience

A linked debit card with fee-free international spending and ATM access offers convenience and cost savings for global transactions. Without this feature, managing overseas expenses can be more difficult and costly, even with foreign currency balances.

Best multi-currency accounts in the UK

When managing money across different currencies, choosing the right multi-currency account can make a big difference to your business or personal finances. To help you navigate the options available in the UK, we’ve compared some of the best accounts side by side, highlighting key features like fees, currency support, and suitability for your business.

Here’s an overview of some of the most popular account options:

Compare multi-currency accounts

| Provider | Currencies Available | Monthly Account Fee | Setup Required | Additional Fees | Business Suitability |

|---|---|---|---|---|---|

| OFX | Manage up to 30+ currencies, with local bank details for GBP, EUR, USD and CAD; payments possible in over 50 currencies to 170+ countries | No setup, no monthly or account‑keeping fees | Fully online registration with ID verification; account opened in minutes via business dashboard | No transfer fees; currency conversions use a competitive margin (typically from ~0.4–1.5%); third‑party intermediary bank charges may apply (not retained by OFX), receiving fees free via FPS, SEPA, ACH, fee charged via Swift | Ideal for UK SMEs and e-commerce businesses needing multi-currency holding, local collection, corporate card capability, batch payments and FX risk tools such as forward contracts |

| Barclays | Single-currency accounts available in over 17 currencies (e.g. EUR, USD, CAD); one currency per account1 | No fee if high average balances or linked corporate package; see tariff for details2 | Online application or branch, with business verification | FX mark‑ups based on Barclays reference rate; settlement delays for some currencies; possible transfer fees via SWIFT/SEPA3 | Best for businesses making repeated payments in a single foreign currency and holding GBP accounts with Barclays |

| Wise | Hold and convert over 40 currencies; local account details for 23+ currencies (e.g. EUR IBAN, US routing)4 | One‑off £45 registration fee; no recurring subscription5 | Fully online set‑up; open within minutes via business dashboard | Currency conversion at mid‑market rate, charges sending transfer fees (from 0.33%); receiving fees free non-Swift/non-wire ACH, fee charged for Swift and ACH6 , be aware of method to pay for transfer e.g. card vs bank transfer variable fees increase | Ideal for SMEs, freelancers or international startups needing transparent pricing, batch payments, local bank details and expense management |

| Revolut | Multi‑currency IBAN accounts supporting 25+ currencies including GBP, EUR, USD, AUD, SGD, JPY, and more7 | Plan-dependent: free for basic, higher tiers charge monthly fees (Grow/Scale)8 | Fully app-based signup online in minutes; no branch visits | Currency exchanges use mid-market rate up to plan limits; fees may apply outside plan thresholds or to payment acceptance9 | Very well-suited to fast-growing businesses and start-ups needing multi-currency spending, team cards, and expense controls |

| Lloyds | Business Foreign Currency Accounts available in multiple individual currencies; must hold individual currency account per currency10 | May apply corporate international banking fees; International Current Account fee ≈ £7.50/month if used alongside currency accounts11 | Set-up via specialist team or corporate representative; eligibility requires turnover thresholds (e.g. >£3m)12 | FX margins on exchanges; charges for international transfers via commercial services; possible correspondent bank fees13 | Best suited for larger trading businesses that require dedicated currency accounts and full foreign exchange support |

| Payoneer | Hold and manage funds in 150+ currencies with local receiving accounts in USD, EUR, GBP, JPY and others | No monthly account fees for standard accounts; fees apply on some services (e.g., currency conversion, withdrawals) | Fully online signup with ID verification, typically completed within minutes | Currency conversion fees typically around 0.5% to 2%; withdrawal and payment fees vary by currency and method14 | Suitable for freelancers, e-commerce sellers, and businesses needing global payments, mass payouts, and multi-currency receiving accounts |

While traditional banks in the UK do offer multi-currency accounts, they often require separate accounts for each currency and may charge monthly fees, conversion costs, or set minimum balance requirements. If you’re looking to simplify currency management, reduce fees, and speed up international transactions, digital-first multi-currency accounts, such as the OFX Global Business Account are a smart alternative worth considering.

What currencies are usually available for the UK in multi-currency accounts?

Most UK-based multi-currency accounts support major global currencies such as:

- US dollars (USD)

- Euros (EUR)

- British pounds (GBP)

- Australian dollars (AUD)

- Japanese yen (JPY)

- Canadian dollars (CAD)

- Swiss francs (CHF)

- Singapore dollars (SGD)

- Chinese yuan (CNY)

- New Zealand dollars (NZD)

Some providers offer significantly broader coverage.

For example, the OFX Global Business Account lets you hold and manage balances in over 30 currencies with local bank details in GBP, USD, EUR, and CAD. With no monthly fees, full digital setup, and support for payments to 180+ countries, OFX offers a highly flexible and cost-effective solution for UK businesses looking to simplify their international payments.

What is the eligibility in the UK for a multi-currency account?

Eligibility for a multi-currency account in the UK depends on the type of provider you choose. Traditional banks usually require you to be a UK resident and already hold a standard current account with them before you can apply for a multi-currency option. These accounts may also come with additional conditions, such as minimum deposits or account usage requirements.

For businesses, companies registered in the UK can usually apply with basic documentation like proof of incorporation, director details, and ID. This makes digital providers a flexible and efficient choice for individuals or businesses needing to manage money across different currencies.

OFX multi-currency accounts are available exclusively to business customers. However, international businesses can still apply if they’re authorised to operate in the UK and have a valid Companies House registration number. Personal customers can use OFX to send and receive money in various currencies through the website or mobile app.

How to open a multi-currency account

Opening a multi-currency account in the UK is generally straightforward, but exact requirements can vary depending on the provider.

Most will ask for proof of identity and business details to comply with regulatory checks and ensure your account is set up securely.

To get started, you will usually need:

- Proof of identity: This typically means a valid passport or UK driving licence for the business owner or any authorised signatories.

- Business documentation: Including your company registration number, proof of trading address, and sometimes details about your business activities.

- Purpose of the account: Some providers may ask about your intended use, such as which currencies you need and the countries you trade with, to tailor the service and meet compliance requirements.

Providers will also expect you to review and agree to their terms around account fees, transaction charges, minimum balances, and currency conversion policies. Being familiar with these details helps avoid any unexpected costs or restrictions later on.

OFX offers a simple setup process with no monthly fees or minimum balance requirements, making it accessible for businesses of all sizes.

Why OFX stands out for UK businesses

OFX’s Global Business Account offers a highly flexible, cost-effective solution tailored for UK businesses.

With access to multi-currency accounts within the Global Business Account, you can manage and hold balances in over 30 currencies, receive payments in local GBP, USD, EUR or CAD accounts, and send or receive funds across 50+ currencies in 180+ countries, all from a single digital dashboard with no monthly fees or hidden charges.

OFX offers a multi-currency corporate card directly linked to your Global Business Account, helping you to keep track of purchases, capture receipts and manage your business finances online.

Ready to simplify your global payments? See our business pricing or request a demo today and start managing international transactions with less admin, lower costs, and full control.

Best multi-currency accounts FAQs

How do multi-currency accounts work?

Multi-currency accounts let UK businesses hold, send, and receive multiple currencies without immediate conversion, offering features like real-time rate tracking, batch payments, and accounting integration for better control of international finances.

How are multi-currency accounts different from regular bank accounts?

Unlike regular UK business bank accounts that hold only GBP, multi-currency business accounts let you hold and transact in various currencies directly, reducing conversion fees and delays. They offer flexibility and control over when to convert funds, helping international businesses manage payments efficiently.

Where can I find multi-currency accounts in the UK?

- OFX

- Barclays

- Lloyds

- NatWest

- Santander

- Wise

- Revolut

- Payoneer

What are the top foreign currency accounts in the UK in 2025?

Here are some of the leading foreign currency account providers for UK businesses in 2025:

- OFX Global Business Account

- Barclays

- Wise

- Revolut

- Lloyds

- Payoneer

- NatWest

- Santander

Looking for an alternative to your bank?

1 https://wise.com/gb/blog/best-multi-currency-business-bank-account-uk

2 https://www.barclays.co.uk/business-banking

3 https://www.barclayscorporate.com/solutions/foreign-exchange

4 https://wise.com/gb/blog/wise-business-account-requirements-uk

5 https://wise.com/business

6 https://wise.com/business

7 https://link.revolut.com/e/blog-case-power-biz-multi-currency

8 https://www.revolut.com/business/business-account-plans

9 https://www.revolut.com/business/multi-currency-accounts

10 https://www.lloydsbank.com/business/international/commercial-foreign-currency-account.html

11 https://www.lloydsbank.com/international/products-and-services/current-accounts/international-account.html

12 https://www.lloydsbank.com/business/international.html

13 https://www.lloydsbank.com/business/commercial-banking/rates-and-charges/international-services-rates-and-charges.html

14 https://www.payoneer.com/resources/how-to-use-payoneer/everything-you-need-to-know-about-smb-business-payments/