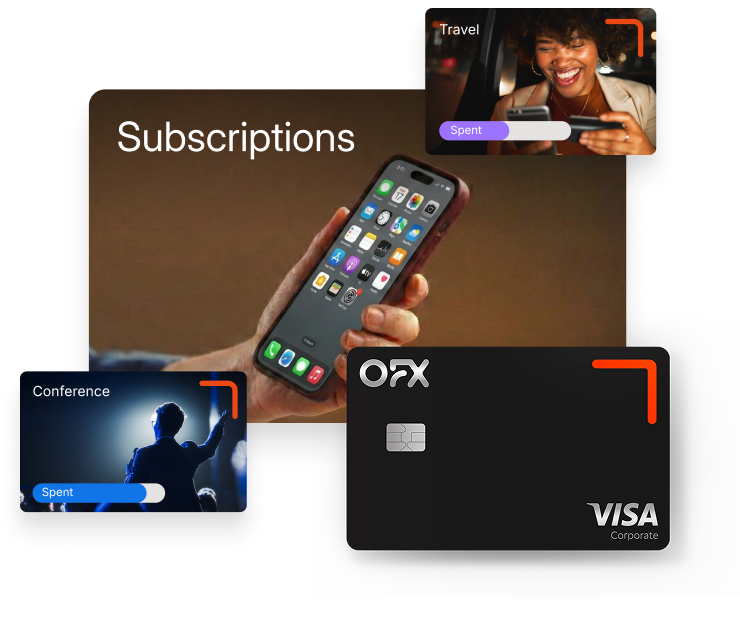

Physical and virtual corporate cards

Spend with control. Grow with confidence.

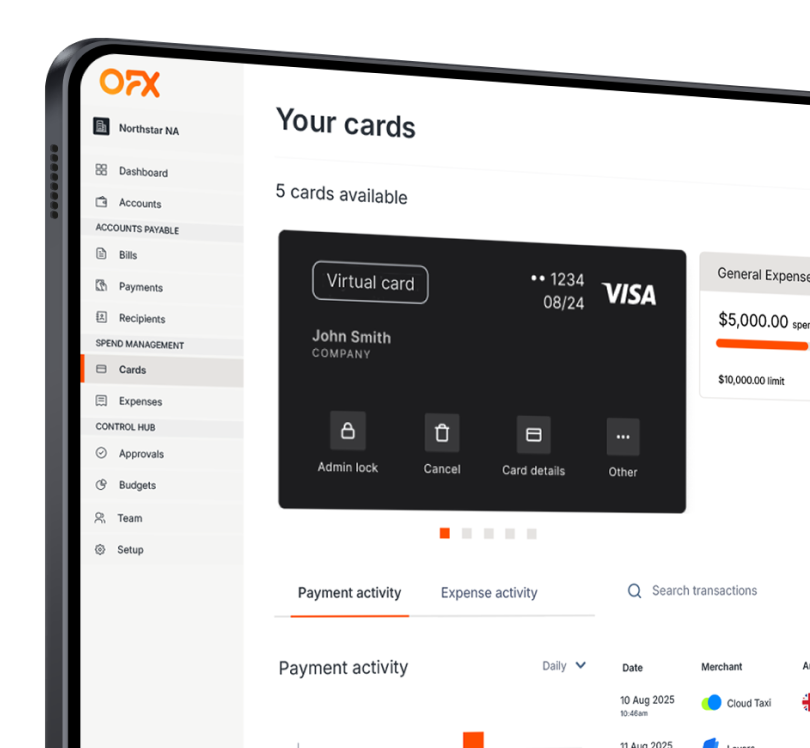

Issue cards on demand, set limits instantly, and track local and global spend as it happens.

See OFX Corporate Cards in action.

Track, control and understand spend across your business.

Rethink your corporate card strategy. A better solution is just around the corner.

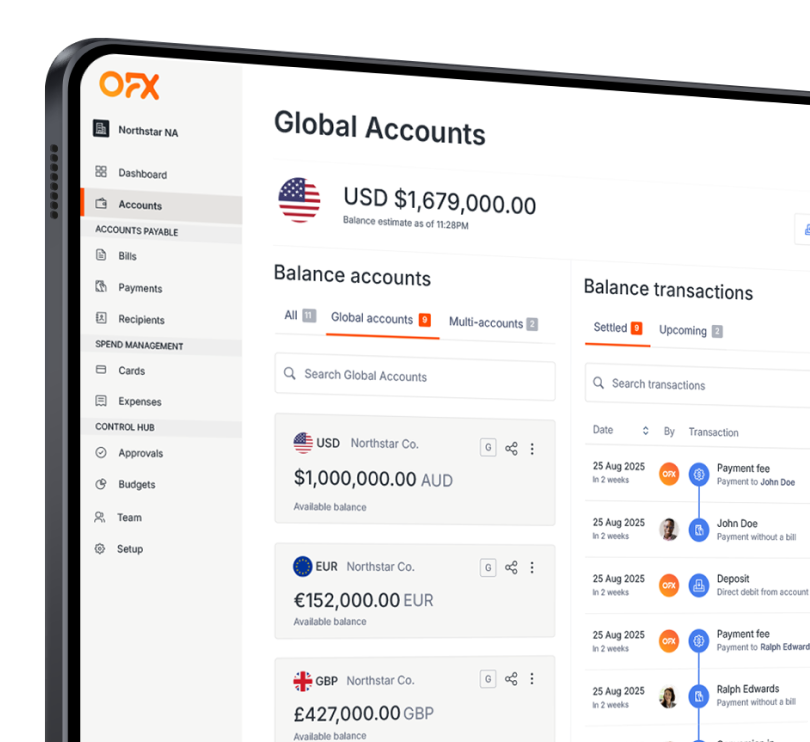

End-to-end visibility for finance teams.

Achieve real-time spend visibility, set budget controls to existing workflows on Full Suite plan and so much more. Say goodbye to end of month chaos.

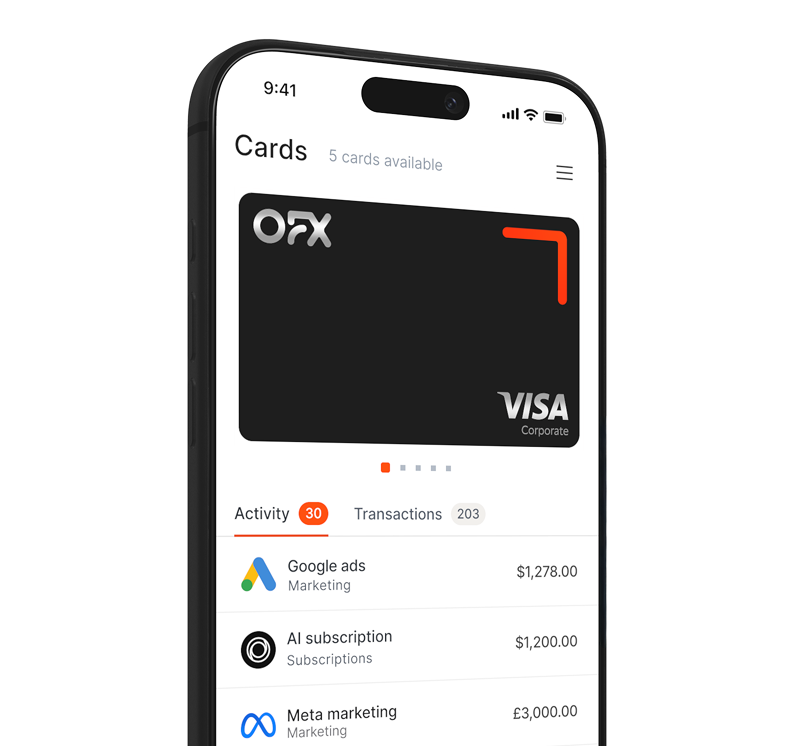

Simplified local and global spend.

Manage local and cross-border payments easily from your OFX Corporate Cards and one smart expense management platform.

Give every card a purpose.

Issue cards by role, team, project or subscription with spend limits. Discover how easy it is to set up with OFX.

Experience the power of OFX.

More spend control.

Start your free trial. Nothing to lose, everything to gain. The real savings start now.

Clients love us. Here’s why.

FAQs

What’s involved in onboarding with OFX?

Onboarding (PDF) takes around 15 minutes to complete online, followed by a verification review by our team to ensure your account is secure and ready for transacting. This upfront step helps protect your business and supports smoother access to OFX products from day one. You’ll also have a dedicated Activation Specialist to get you set up.

How quickly can my team get up and running with OFX Corporate Cards?

Our virtual cards are generated in seconds for team members, which makes it ideal for urgent, fast-paced business needs.

How do I get started with OFX Corporate Cards?

Once your OFX business account is approved and set up, you can start issuing virtual corporate cards for immediate use.

How does OFX help keep business spend secure?

With OFX Corporate Cards, your business spend stays protected. From encrypted mobile wallets to instant lock controls and fraud monitoring, and secure access with two-step verification, you can move fast without worrying about safety.

Can I link my card payments to my Xero or QuickBooks Online account?

Yes, we integrate with Xero and QuickBooks Online. Sync your card expenses automatically with Xero and QuickBooks Online, eliminating reconciliation headaches. Capture receipts in real-time, track every employee spend, and stay in control of your business finances, all from one powerful platform.

© 2026 UKForex Limited (trading as “OFX”) is registered in England and Wales (Company No. 04631395). Our registered office is at 4th Floor, The White Chapel Building, 10 Whitechapel High St, London E1 8QS. We are authorised by the Financial Conduct Authority as an Electronic Money Institution (Firm Ref. No. 902028).

Visa is a trademark owned by Visa International Service Association and used under license.

Apple Pay is a service provided by certain Apple affiliates, as designated by the Apple Pay privacy notice. Neither Apple Inc. nor its affiliates are a bank. Any card used in Apple Pay is offered by the card issuer.

Google Play and Google Pay are trademarks of Google LLC.

*Cashback rewards are only available to those OFX Clients who are on an OFX Full-Suite plan or an OFX Custom plan, as each of those terms are defined in the Subscription Agreement (Business). You can earn 0.5% cashback rewards when you make Qualifying Purchases using an OFX Card issued to you and this OFX Card is linked to an OFX Business Account that is open, active and in good standing. The OFX Card making the Qualifying Purchases can be a digital or a physical card and it can also include any OFX Cards issued to Additional Cardholders. Any cashback rewards earned will be applied to the OFX Business Account.