Limited time offer.

Bonus cashback.

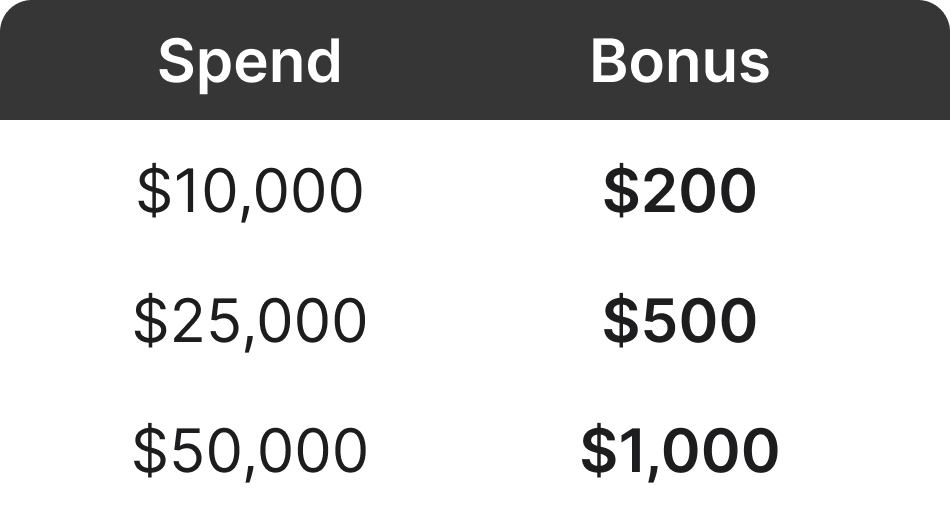

Earn up to $1,000.

Earn cashback when you use your OFX Corporate Card on local or global spend.

Hurry – limited time only. Ends February 28, 2026.

How it works.

Spend more, earn more.

For a limited time, earn up to $1,000 cashback when you activate and spend across your OFX Corporate Cards. The more you spend, the more you’ll earn.

That’s more money back on everyday spending.

Invoices straight from your inbox.

Invoice data is automatically captured from your emails (in the body and via attachments).

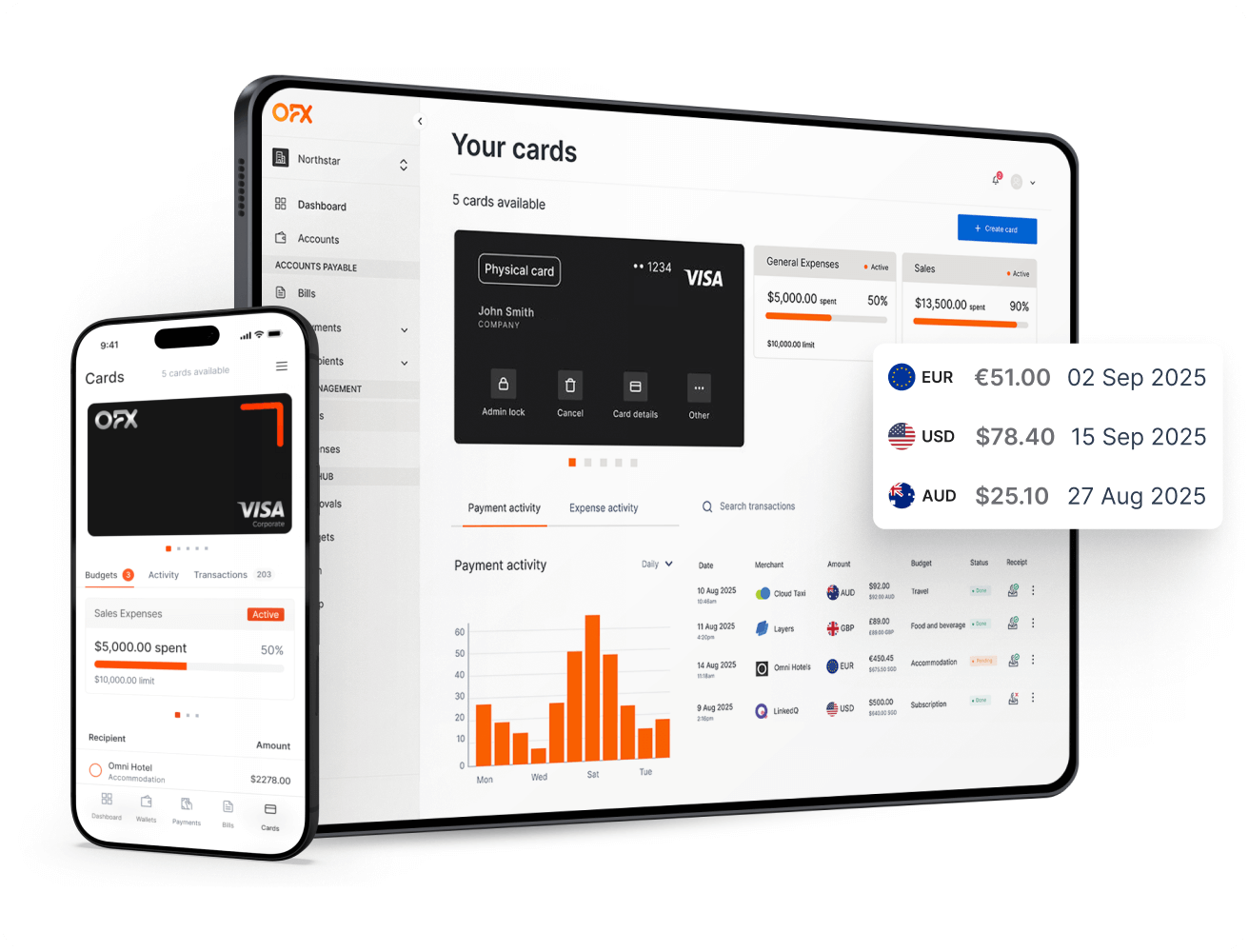

Skip the FX fees.

Make zero FX fee transactions with your card in 30+ currencies, using your account balances.

Goodbye, expense control worries.

Set budgets and automate approval policies card-by-card. Never worry about going over budget again.

Total recurring expense oversight.

Avoid missed payments and duplications with unique company cards that track recurring expenses.

Lock or cancel cards immediately.

When a team member leaves, simply cancel the company cards they have access to.

Not all features are available on all plans.

Clients love us. Here’s why.

Corporate Cards FAQs

Who is this offer available to?

This offer is exclusively available to selected clients who have been invited to participate. The offer is automatically activated when you sign-up for an OFX Corporate Card and make local or international transactions through the card during the promotional period.

You can unlock cashback based on your spend until February 28, 2026.

- Receive $200 for $10,000 worth of transactions.

- Receive $500 for $25,000 worth of transactions.

- Receive $1,000 for $50,000 worth of transactions.

Can I make transactions in all currencies ?

This offer applies for any international or local OFX Corporate Card transactions across 30+ currencies.

Do I need a promo code?

Let’s not overcomplicate it. This limited time offer has automatically been applied. Simply sign up for an OFX Corporate Card and make local or international transactions through the card during the promotional period. We’ll cover the rest.

Is there a limit to how many transactions I can make?

There’s no limit. Whether you’re managing business expenses, FX transactions, or making everyday payments, now is the perfect time to put your OFX Corporate Card to work. Make as many payments as you need during the promotional period. Earn up to $1,000 for $50,000 worth of transactions.

Is this offer available on my personal account with OFX?

No. This offer is exclusively available to selected clients who have been invited to participate via their OFX business account(s).

How does the card work with the OFX Global Business Account?

Our Corporate Card is directly linked to the funds in your OFX Global Business Account. Save money by pre-converting your local currency to international currencies when the exchange rates suit you. With our OFX Corporate Card, access USD and 30+ international currencies.

When making a payment in any of those 30+ currencies, our card automatically draws funds from that currency account, allowing you to spend like a local with no international transaction fees. This applies if there are sufficient funds in those accounts.

If you do not hold funds in the currency you are spending in, or have insufficient foreign currency balances, we’ll automatically convert from your local currency at competitive exchange rates. We’ll automatically convert your local currency to the currency of the merchant in your Global Business Account and process the transaction in the same currency of the merchant.

Can I create company cards linked to my OFX Global Business Account?

Yes. You can set up a card for each subscription and manage your expenses per card, with built-in control limits. If your subscription ends, you can cancel the card anytime to ensure you’re not charged on that fee. If there is a security breach on a particular card, simply delete that card. This means easier reconciliation, oversight, and added security.

Bonus cashback. Earn up to $1,000.

*Terms and Conditions

This offer is available to selected existing clients using OFX Corporate Cards until February 28, 2026. To earn the bonus cashback, your business must create at least one OFX Corporate Card and spend on card transactions before February 28, 2026. Bonus cashback will be calculated per Business Account as follows: a) a AU$200 bonus if you transact AU$10,000; or b) a AU$500 bonus if you transact AU$25,000; or c) a AU$1,000 bonus if you transact AU$50,000 or more. For FX card transactions not involving AUD, we will calculate the local equivalent using the current spot rate. Any returned transactions, refunds, chargebacks, or other similar credits that reduce the total card transaction value will be deducted from the minimum spend threshold. After February 28, 2026 we will review the total card spend across all cards linked to your Business Account during the offer period and credit your Business Account with the bonus cashback by March 31, 2026 provided that your account is in good standing. This offer is non-transferable and cannot be combined with any other offer unless expressly stated. This offer may only be used for eligible OFX card transactions. We reserve the right to change, withdraw, or extend this offer at any time.

Visa is a trademark owned by Visa International Service Association and used under license.

Apple Pay is a service provided by certain Apple affiliates, as designated by the Apple Pay privacy notice. Neither Apple Inc. nor its affiliates are a bank. Any card used in Apple Pay is offered by the card issuer. Apple is a trademark of Apple Inc.

Google Play and Google Pay are trademarks of Google LLC.

© 2026 OzForex Limited. OzForex Limited (trading as OFX) regulated by ASIC (AFS Licence number 226 484) | ABN 65 092 375 703 | Member of the Australian Financial Complaints Authority (AFCA). The information on this website does not take into account the investment objectives, financial situation and needs of any particular person. We make no recommendation as to the merits of any financial product referred to on this website. Please review our Product Disclosure Statement, Target Market Determination and Financial Services Guide prior to making a decision.